In The Depth of Deeptech Is Our Climate Solutions

By 2030, deep-tech industries are projected to be worth €8 trillion. The question is not if, but when, you’ll invest in the future of innovation.

How deeptech is our best bet solving climate challenges?

At Earth VC, we firmly believe solving climate change won’t happen with software alone—after all, our emissions come from the tangible world. If we break it down: nearly 40% of global greenhouse gas (GHG) emissions come from electricity and heat production, largely due to burning coal, oil, and natural gas. Agriculture, forestry, and land use add another 18.4% - attributing to deforestation, livestock, rice cultivation, and more. What about transportation? That’s another 17%, with road transport alone clocking in at 12%.

In 2022, emissions from the $5 trillion global energy market hit a staggering 37 billion tons of CO2—three-quarters of the global total, according to the IEA. Climate experts, from a BCG report, predict that 75% of GHG emissions reduction will require new technologies. Innovations like nuclear fusion, solid-state batteries, CO2-based materials and chemicals, and electrolysis are at the forefront, with deep tech companies leading the charge. Additionally, other deep tech ventures are addressing resource scarcity by exploring solutions such as alternative proteins, biorecycling, deep-sea mining, and green solvents.

As our investment team Nam Tran shared after SLUSH 2024, a pivotal question resonated throughout the event: “Will people who don’t care about the environment adopt your product?” That’s the real test. It’s not enough for a technology to reduce emissions, it must solve an urgent problem, compete on cost, performance, and convenience. Fission energy needs to scale safely and efficiently. Cultivated meat must taste as good as (or better than) the real thing. Advanced materials need to outperform existing options or make them look outrageously expensive in comparison. Onto deeptech itself.

The Nature of Deeptech

MIT defines deep tech as "science-based technology solutions" intertwined with big, game-changing uncertainties - a perfect fit for a world where technology evolves at lightning speed. And Deep-tech startups? They’re not just businesses; they’re missions.

These ventures operate on the cutting edge of science, tackling wicked-hard problems with long, uncertain R&D cycles. They build tangible, often regulated products, partner with universities and research hubs, and aim to solve massive, public-scale challenges. Oh, and they thrive on risk, though de-risking every step is their obsession.

Deep tech isn’t just "cool"—it’s the tech of the future. Climate disasters, food and water scarcity, pandemics, or disease? If there’s a colossal problem staring humanity down, odds are a deep-tech startup is already working on it. As investments, though, they’re not for the faint of heart. These ventures require more capital, more patience, and nerves of steel. But when deep tech wins, it wins big—creating markets where barriers to entry are sky-high and might even shield investors from the rollercoaster of market volatility.

And here’s the kicker: deep tech is booming. This BCG report predicts that by 2030, deep-tech industries could be worth a jaw-dropping €8 trillion. Venture capitalists are paying attention—deep tech now claims a steady 20% of VC funding, up from just 10% a decade ago. The math? Impressive. The stakes? Enormous.

Deeptech founders

The biggest challenges require the most ambitious founders, and deeptech founders are among the most ambitious of them all. The best teams exhibit three undeniable green flags.

First, deep tech isn’t just about having a good idea—it’s about mastering the technical nuances of the industry. These founders often spend years in their field, honing their expertise to tackle problems with confidence and create solutions that are not just innovative but viable. Second, a business-savvy co-founder is a must. While technical brilliance is often a given in deep tech, commercialization expertise can be rare. A co-founder with real-world entrepreneurial experience can navigate market strategy, scale the business, and turn groundbreaking tech into market-ready products.

Finally, storytelling is the secret sauce which is rarely mentioned. No one’s writing million-dollar checks if they don’t understand what you’re saying, why the market needs you now, or how your solution has a killer use-case they’ve been waiting for. Every deep tech team needs someone—ideally a founder or leader—who can translate Saharan-dry technicality into a crystal-clear vision of Shangri-la. It’s this perfect blend of scientific mastery, business acumen, and narrative magic that sets the best deep tech teams apart, enabling them not just to build startups but to shape the future.

The Grind Behind the Glory: From Lab to Real World

Deep tech’s early challenges are often more about science than business. Moving a technology from the lab into the real world is like taming a wild beast. Researchers-turned-founders may obsess over the tech itself, losing sight of the problem they’re solving. Add to that the tricky dynamics of aligning with investors, navigating complex IP ownership, and crafting viable business models.

But arguably, one of the largest obstacles comes at later-stage. Over 80% of deep-tech startups work on physical products, which means engineering, unit economics, and scaling challenges awaits. As startups grow, funding rounds get exponentially larger—Series C rounds can demand 20 times more capital than Series A. For investors of deep-tech, patience isn’t just a virtue; it’s the non-negotiable currency (more on patience in a bit).

“Understanding is the most beautiful word in the dictionary, because it gives us such a competitive advantage to tap into the most promising opportunities in deeptech of our generation”

- Duc Pham, Principal of Earth VC

Risk, Resilience, and Reward: Playing the Long Game

Deep-tech likes to take its time—normally 25–40% longer between funding rounds compared to regular tech startups. Failure risks loom at every stage, and multiround investments are common. For larger funds, sticking with a company across multiple rounds can mean putting nearly half their investments on the line.

Then there’s the deepest depth of the deep-tech pool: nuclear fusion, artificial general intelligence, quantum computing among other mind-bending technologies. These ventures carry scientific risks that don’t just stop at the lab; they follow you all the way to growth and commercialization. The risk-averse need not apply. But for those bold enough to dive in, the rewards could reshape portfolios, and even entire industries.

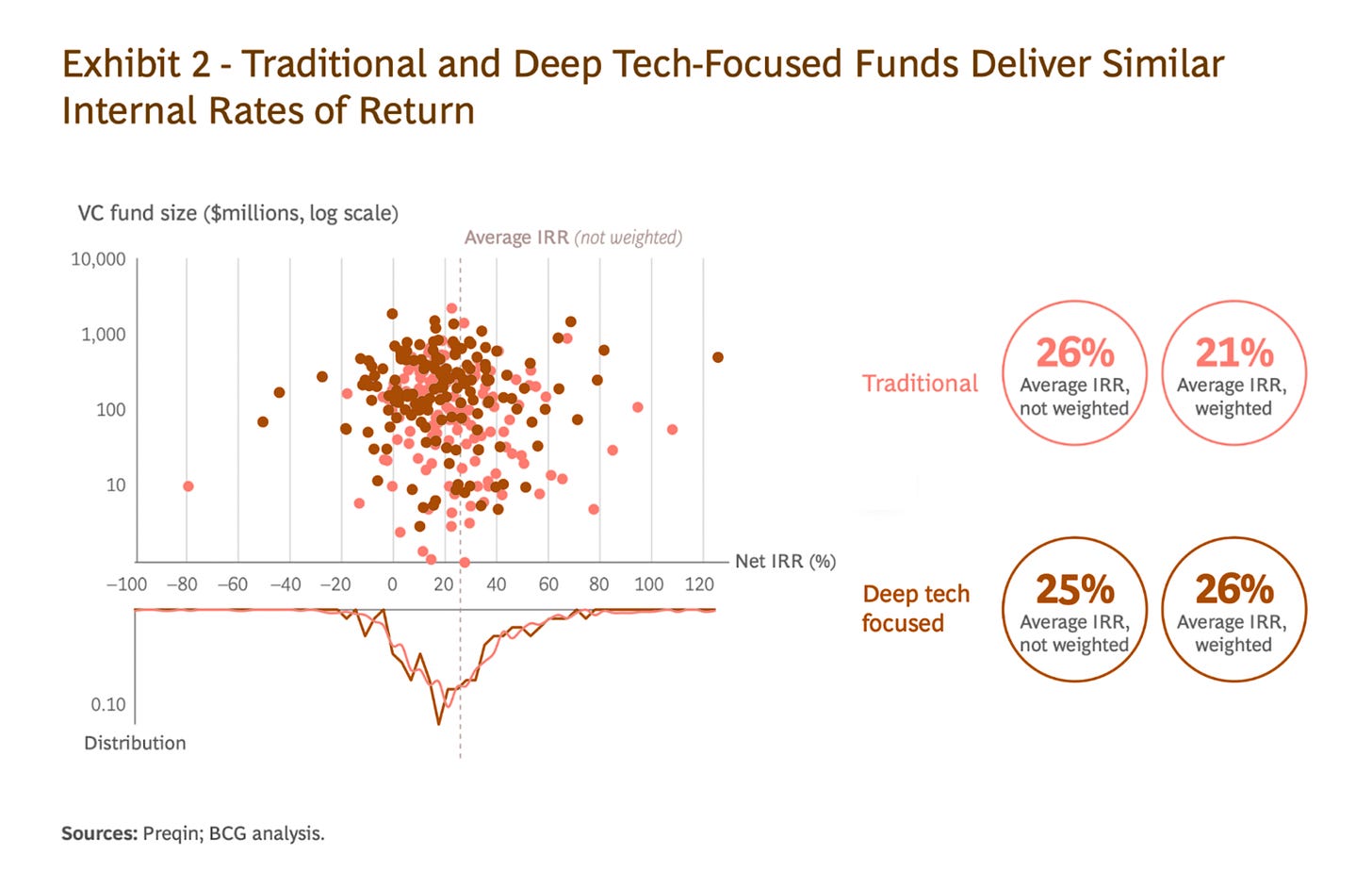

Surprisingly however, while deep tech investments tend to be complex and often have lengthy time horizons, BCG analysis shows almost no difference in the internal rate of return between traditional and deep tech-focused venture funds. Another factor is that the difficulty of finding an exit strategy is dissipating. There is little difference in the percentages of traditional and deep tech venture investments that cashed out via corporate acquisitions (53% and 51%, respectively), IPOs (36% and 31%), and private equity buyouts (7% and 3%).

Deeptech Renaissance: Before Bits, Atoms Ruled

Imagine the mid-20th century, when people spoke of ‘technological innovation,’ they were referring to hardware-based technologies—advancements that required years, if not decades, of research and development.

These were the hard, deeply-researched technologies that defined the era. The United States had just built its first nuclear reactor in Chicago in 1942; the Brits and French joined forces to launch the Concorde in 1969; and Japan just introduced the high-speed rail (Shinkansen) in 1964. At the very same time, the USSR achieved groundbreaking milestones, launching Sputnik 1—the first artificial satellite—in 1957 and sending Yuri Gagarin on the first human spaceflight in 1961. These feats “encouraged” NASA to respond with achievements of its own, such as the launch of the first commercial satellite, Echo 1, in 1960 and the historic Moon landing with Apollo 11 in 1969.

Fast forward to the 1970s, and the spotlight started to shift. Software began to dominate the conversation, and innovation in the tangible, physical world took a backseat for a while. Sure, there were still impressive developments, but they weren’t quite as jaw-dropping—or as frequent—as before.

That is, until October 2024, when SpaceX’s “Meme God” and his team pulled off the extraordinary feat of catching a skyscraper-sized rocket booster - the Super Heavy. With this remarkable achievement, hardtech made a stunning comeback, reminding the world that tangible, physical innovation still holds the power to inspire awe and reignite a century’s worth of vision and belief.

The Bottom Line

Deep tech is not just an investment; it’s a statement. It’s for the dreamers who execute on their dreams where others see unsolvable problems, and for investors who can stomach the long haul - who believe the future is worth fighting for. Yes, it’s risky. Yes, it’s slow. But when deep tech succeeds, it doesn’t just pay off—it changes the world.

In the words of Nicolai Tangen, CEO of the 1,8 trillion dollar sovereign wealth fund Norges BIM (the largest in the world): “In an unsuitable world. The value of your investments are Zero”.